Table of Contents

5 Ways U.S. Brands Avoid Insulated Drinkware Tariffs

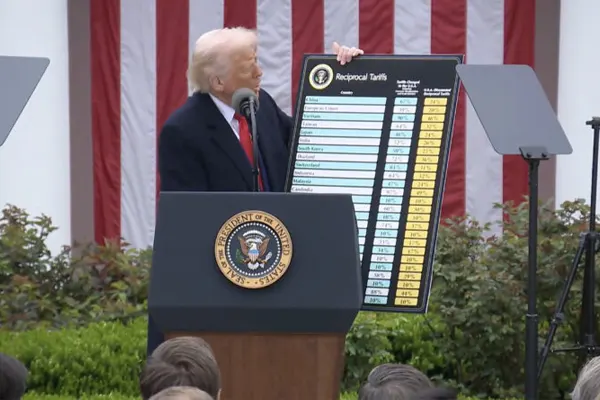

In 2025, U.S. brands importing stainless steel drinkware face significant challenges due to a 25% tariff on steel and aluminum imports and a 10% universal tariff, with Chinese goods facing rates up to 30% following a temporary U.S.-China agreement (U.S. Trade Representative, May 2025). These tariffs increase costs and disrupt supply chains for products like tumblers, water bottles, and thermoses. This guide outlines five actionable strategies to help U.S. brands avoid high tariffs, optimize costs, and ensure efficient imports.

The Financial Impact of Tariffs

Eroding Profit Margins

The 25% tariff on steel imports directly raises the cost of stainless steel drinkware, reducing profit margins. For example, a $20 wholesale tumbler incurs an additional $5 in tariffs, forcing brands to absorb costs or raise prices.

Impact on Consumer Pricing

Higher tariffs often lead to increased retail prices, risking customer pushback. A 2025 trade report estimates that 60% of U.S. brands have passed tariff costs to consumers, affecting competitiveness (U.S. International Trade Commission, 2025).

Temporary Tariff Relief

On May 12, 2025, the U.S. and China agreed to a 90-day tariff reduction, lowering rates on Chinese goods from 145% to approximately 30%. However, it’s unclear if stainless steel drinkware (HS code 9617.00) is included. Brands must verify applicability with customs authorities.

5 Strategies to Avoid High Tariffs

1. Source from Tariff-Friendly Countries

Manufacturing in countries like Cambodia, Thailand, or Mexico avoids the 25% steel tariff and high Chinese tariffs. For instance, Mexico’s proximity to the U.S. reduces shipping costs and delivery times, enhancing efficiency.

2. Use Correct HS Codes

Accurate HS code classification (e.g., 9617.00.1900 for vacuum bottles) ensures proper tariff rates. Misclassifying drinkware as kitchenware (7323.93) can increase duties from 2.7% to 3.4% in the U.S. Verify codes with suppliers and customs brokers.

3. Leverage Free Trade Agreements

The USMCA (U.S.-Mexico-Canada Agreement) allows tariff-free imports from Mexico for qualifying goods. Ensure suppliers meet USMCA origin rules to eliminate duties on stainless steel drinkware.

4. Diversify Supply Chains

Relying on multiple manufacturing locations reduces risks from tariff hikes or trade disputes. A diversified supply chain ensures stability if one country faces new tariffs.

5. Negotiate with Suppliers

Work with suppliers to share tariff-related costs or optimize production for lower-duty materials. Request detailed HS code breakdowns and consistent documentation to streamline customs processes.

| Product Type | HS Code | U.S. Tariff Rate (2025) | Notes |

|---|---|---|---|

| Vacuum Bottles | 9617.00.1900 | 2.7% (non-China) / 30% (China) | Verify temporary tariff relief |

| Vacuum Cups | 9617.00.9000 | 2.7% (non-China) / 30% (China) | Includes tumblers |

| Insulated Food Jars | 9617.00.9000 | 2.7% (non-China) / 30% (China) | For meals, not beverages |

| Plastic Lids/Straws | 3924.10.4000 | 3.1% | Separate classification |

Source: U.S. International Trade Commission, 2025.

Errores Comunes de Aranceles a Evitar

- Códigos SA Incorrectos: Clasificar erróneamente los recipientes de acero inoxidable para bebidas como utensilios de cocina generales aumenta los aranceles.

- Ignoring Accessories: Las tapas o pajitas pueden tener códigos SA diferentes (por ejemplo, 3924.10.4000), lo que lleva a disputas aduaneras.

- Asumir Alivio Arancelario: El acuerdo entre EE. UU. y China puede no aplicarse a los recipientes para bebidas. Confirme siempre con las autoridades aduaneras.

- Dependencia de un Solo País: La dependencia excesiva de la fabricación china conlleva riesgos de aranceles elevados y interrupciones en la cadena de suministro.

Cómo Implementar el Abastecimiento Libre de Aranceles

- Verificar Códigos SA: Solicite a los proveedores que proporcionen los códigos SA para todos los componentes, incluidos los accesorios como las tapas.

- Elegir Proveedores Favorables en Cuanto a Aranceles: Asóciese con fabricantes en México, Camboya o Tailandia para evitar aranceles elevados.

- Aprovechar los Beneficios del T-MEC: Asegúrese de que los productos cumplan con las reglas de origen del T-MEC para exenciones arancelarias.

- Consult Customs Experts: Utilice recursos como el Servicio de Aduanas de EE. UU. o la Organización Mundial de Aduanas para clasificaciones precisas.

- Monitor Tariff Updates: Stay informed about trade agreements, such as the 2025 U.S.-China temporary reduction.

Conclusion: Optimize Your Drinkware Imports

High tariffs on stainless steel drinkware challenge U.S. brands, but strategic sourcing can minimize costs and ensure competitiveness. By leveraging tariff-friendly manufacturing, accurate HS codes, and free trade agreements, brands can streamline imports and protect profit margins. Consult customs experts or refer to the U.S. International Trade Commission for the latest tariff guidance.

cURL Too many subrequests. cURL Too many subrequests.cURL Too many subrequests.

Have Anything To Ask Us?

Please fill in the detailed information in the form, and we will contact you as soon as possible